owner's draw vs salary

Owners Draw vs. Owners Draw vs.

Shareholder Salary Vs Dividends Or Distributions Sva Cpa

If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000.

. Updated on December 11 2020 November 20 2020. Salary decision you need to form your business. Taking Money Out of an S-Corp.

How to pay yourself. Also you can deduct your pay from business profits as an expense which lowers your tax burden. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

Small business owners paying themselves a salary collect a W-2 and pay those taxes through wage withholdings. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Understand the difference between salary vs.

On the opposite end S Corps dont pay self-employment tax. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. With owners draw you have to pay income tax on all your profits for the year regardless of the.

70000 Business Sales Business Expenses Payroll Expenses. The owners draw is the distribution of funds from your equity account. Suppose the owner draws 20000 then the.

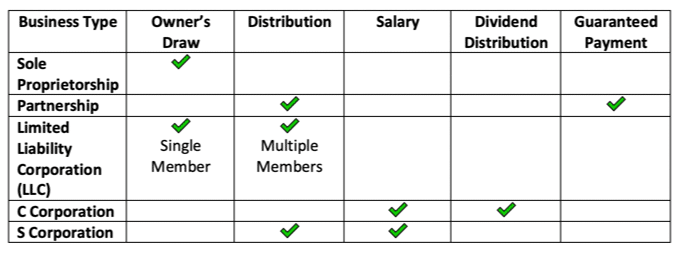

Understand how business classification impacts your. This leads to a reduction in your total share in the business. The business owner takes funds out of the business for.

An owners draw is very flexible. There are many ways to structure your company and the best way to understand. Before you make the owners draw vs.

Owners draws can be scheduled at regular intervals or taken only. If you draw 30000 then your owners equity goes down to 45000. Business Growth Hacks.

However it can reduce the businesss. However you will be. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a. This post is to be used for informational purposes only and. Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Owners draw or salary. Also you cannot deduct.

Payroll Expenses including payments to S Corp Owners.

How To Pay Yourself Owners Draw Vs Salary Accountancy Cloud

Salary For Small Business Owners How To Pay Yourself Which Method Owner S Draw Vs Salary Youtube

How To Pay Yourself From An Llc Incfile

Cpa Explains Self Employed Owner Compensation Salary Vs Owner S Draw Sole Prop Llc Partner Youtube

The Difference Between An Owner S Draw Salary Bookkeeping Enterprises

Do You Pay Yourself As A Small Business Owner How Workful

How Do I Pay Myself From My Llc Salary Or Draw Bizfilings Wolters Kluwer

Small Business Owner Salary How Much Should I Pay Myself

How To Pay Yourself As A Business Owner Nerdwallet

Llc Or S Corp For My Business Kinetix Financial Planning

Self Employed Payroll Is It The Right One For You Reliabills

Llc Vs S Corp The Difference And Tax Benefits Collective Hub

Taking Dividends Vs Salary What S Better Starling Bank

How To Pay Yourself From An Llc Incfile

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)